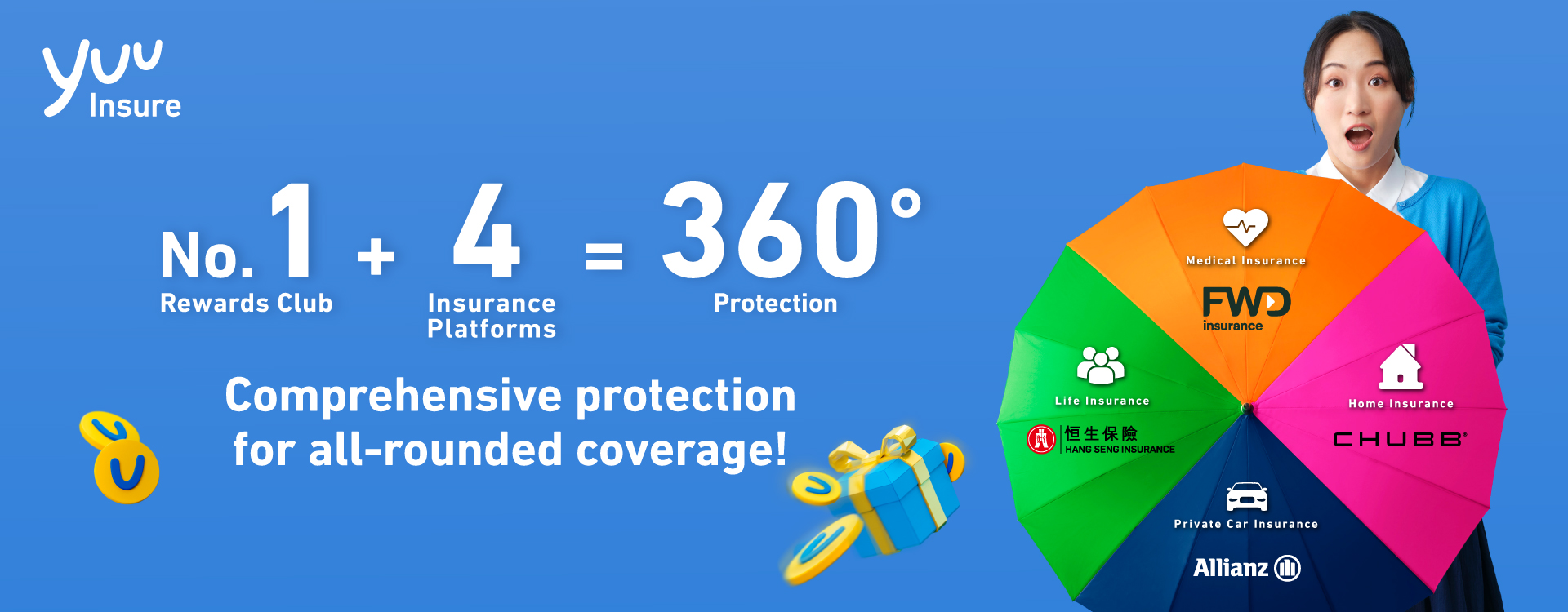

yuu Insure Products

Protect yourself, your loved ones and valuable belongings with our online comprehensive range of insurance products today!

yuu has partnered with quality insurance brands to offer all-round protection for you and your family. It is only a few simple steps in the yuu App to get the insurance coverage you need and earn yuu Points.

Medical

Critical Illness

Personal Accident

Retirement & Wealth Accumulation

Term Life

Travel

Home

Private Car

Private Car Insurance Plan

•

Comprehensive Coverage: Up to HK$250,000 personal accident protection and up to HK$5,000 windscreen protection

•

Affordable: Depending on the value of your car, the premium can be as low as HK$6 a day

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 premium paid.

Know More >

MyHomeGuard

•

Comprehensive Coverage: Home contents cover of up to HK$1,000,000 and Personal liability insurance cover of up to HK$5,000,000

•

Affordable: Premium as low as HK$1.9 per day

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 premium paid.

Know more >

Travel Insurance

•

Comprehensive Coverage: Coverage for medical expenses or trip cancellation due to Covid-19

•

Unlimited Emergency Service: 24-Hour Worldwide Emergency Assistance Services, unlimited benefit amount for Emergency Medical Evacuation and/or Repatriation

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 premium paid.

Know more >

eFamilyPro Life Insurance Plan

•

Comprehensive Coverage: Up to HK$8,000,000 Life Insurance Protection

•

Affordable: Premiums as low as HK$0.8 per day* & 5-month premium waiver (*Based on the sum insured of HK$500,000 for a 18-year-old non-smoking female)

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first policy year

Know more >

MyCover Critical Illness Plan

•

Protection on Cancer, Heart Attack and Stroke (known as "Big 3 Diseases")

•

Cover carcinoma-in-situ of specific organs: pays 35% of the initial sum insured (Up to HK$400,000)

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know more >

eCancerPro Insurance Plan

•

Comprehensive Coverage: Benefit of up to HK$5,000,000 of Cancer, Carcinoma-in-situ and Early Stage Cancer

•

Affordable: Premium as low as HK$0.3 per day* & 5-month premium waiver (*Based on sum insured of HK$100,000 for a 18-year-old non-smoking male)

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first policy year

Know more >

Easy WealthPlus Endowment Plan 2

•

Lock in an 8-year guaranteed return of up to 4.3% p.a. [1]

•

Combination of savings (100% guaranteed), life protection and policy continuation

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know More >

eIncomePro Deferred Annuity Plan (100% Guaranteed)

•

Qualifying Deferred Annuity Policy: The tax saved within each assessment year can be up to HK$10,200 per taxpayer (assuming an applicable tax rate of 17%)

•

Guaranteed Income: Monthly guaranteed annuity income with a guaranteed internal rate of return 3.02% - 3.30% for 10 years

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first policy year

Know more >

vPrime Medical Plan

•

Certified by the Government: Eligible for tax deduction up to HK$8,000 per Insured Person per year of assessment

•

Full cover for a range of hospitalisation and surgical expenses: Up to HK$12.5 million per Policy Year

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know more >

MyMillion Medical Plan

•

Annual Limit up to HK$4 million without lifetime limit

•

Guaranteed renewal up to actual age 100

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know more >

EasyRefund 100% Global Hospital Cash Plan (3-year)

•

Hospital Cash Benefits: Up to HKD150,000 per year, Daily Hospital Cash Benefit will be paid up to 100 days per year

•

Premium Refund: Up to 103% refund of Total Premiums Paid upon 3-year policy maturity

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first policy year

Know More >

CouponPower Guaranteed Life Insurance Plan

•

Enjoy monthly payout: starting from 2nd Monthiversary of the policy term

•

Guaranteed breakeven period as short as 3 years

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know More >

MySafe Accident Protection Plan

•

Broad accidental death and disability coverage

•

First-in-market scar due to accident cover

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first Policy Year

Know more >

Sport Guard

•

Coverage: Up to HK$80,000 Accidental Death and Permanent Disablement benefit

•

Free and paid policies to choose from

•

A wide range of Covered Sports include yoga, running, gym workout, wakesurfing and more

Know more >

Endowment Life Insurance

•

Guaranteed Cash Value: Provide a Guaranteed Cash Value upon policy maturity

•

Affordable: Premium as low as HK$600 per month

•

Earn yuu Points: Earn 1 yuu Point for every HK$1 of your insurance premium paid in the first policy year

Know more >

yuu Insure Monthly Reward Day - Exclusive for selected yuu Insure customers!

yuu Members with at least one active insurance policy(ies) enrolled via yuu Insure^ can get a 7-Eleven Coupon (valued at HK$20) * for free in the yuu Insure page on the 8th of each month!

^Terms and Conditions apply.

* The Coupons are available on a first-come, first-served basis, while stocks last. For the Terms and Conditions of the Coupon, please refer to the relevant offer page in the yuu Insure section in the yuu App.

yuu Insure Blog - Latest posts

To borrow or not to borrow? Borrow only if you can repay!

Terms and Conditions

1. If you have successfully applied for the following plan(s) (“The Plans”) through the “yuu Insure” section in the yuu App (“App”):

• the Allianz Private Car Insurance Plan underwritten by Allianz Automotive (a division of Allianz Global Corporate & Specialty SE Hong Kong Branch (incorporated in the Federal Republic of Germany with limited liabilities)) (“Allianz”) (“Allianz Insurance Plan”) ;

• the general insurance product(s) underwritten by Chubb Insurance Hong Kong Limited (“Chubb”) (“Chubb Insurance Plans”); and / or

• the life insurance plan(s) underwritten by Hang Seng Insurance Company Limited (“HSIC”) (“HSIC Insurance Plans”)

• the medical insurance plan(s), accident insurance plan, critical illness plan and / or savings insurance plan underwritten by FWD Life Insurance Company (Bermuda) Limited (incorporated in Bermuda with limited liability) (“FWD”) (“FWD Insurance Plans”)

you will earn Base Points of 1 Point for each HK$1 premium paid (unless otherwise specified). If you apply for FWD savings insurance plans and choose the Prepay Option, the prepaid premium will also be eligible for Base Points. In respect of HSIC Insurance Plans and FWD Insurance Plans, you will not be eligible for any Base Point if you exercise the right to cancel the insurance policy during the cooling-off period as provided therein.

Regarding how to use your Points for sharing or redeeming Rewards, please refer to the yuu Rewards Club T&Cs (https://www.yuurewards.com/terms-and-conditions) for details.

For the eligibility and coverage of the The Plans, please refer to the information currently provided by the relevant authorised insurers for details. Each relevant authorised insurer reserves the right at its sole discretion whether to accept or decline your insurance application and issue any insurance policy.

For the eligibility and coverage of the The Plans, please refer to the information currently provided by the relevant authorised insurers for details. Each relevant authorised insurer reserves the right at its sole discretion whether to accept or decline your insurance application and issue any insurance policy.

2. The Base Points you earn will be credited to your yuu Account in accordance with the following timeline:

• Applicable to Chubb Insurance Plans and / or Allianz Insurance Plan - Base Points will first be credited to the eligible yuu Account upon policy issuance. The subsequent Base Points will then be credited to the eligible yuu Account on an annual / monthly basis (subject to policy payment mode) when the premium is successfully settled throughout the period of insurance coverage.

• Applicable to HSIC Insurance Plans and / or FWD Insurance Plans, - Base Points entitled in the first month will be credited to the eligible yuu Account 1 month after expiry of the cooling-off period. Base Points for subsequent premium from monthly payment will be credited to the eligible yuu Account about 2 weeks upon each successful premium collection. Base Points earned is only applicable to the premium paid in the first year while the policy remains in force and the yuu Account remains valid.

• For Chubb Insurance Product(s) purchased through Telesales channel or renewal of policy(ies) of Chubb Insurance Product(s), Base Points will be credited to your yuu Account within three months after premium is received by the relevant authorised insurer.

3. In the event of a refund of policy premium, policy cancellation or policy lapse of the Plans, yuu, Allianz, Chubb, HSIC and FWD reserve the right to deduct the Base Points from your yuu Account.

4. If you use a mobile number that has already registered to an existing yuu Account to sign up for a new yuu Account, this will override the details of the existing Account, including the eligibility for earning Base Points. Under such circumstances, you may no longer be eligible for the subsequent Base Points even though you have contacted us and successfully reclaimed the yuu Points from your previous Account, and / or successfully paid the premium of The and your policy remains in force.

5. yuu reserves the right to terminate the eligibility for Base Points or change the relevant Terms without prior notice. The transaction time shall be based on the computer records of DFI Development (HK) Limited (“DFI”). DFI reserves the right to interpret these Terms and Conditions. In case of any disputes, DFI’s decisions are final.

6. We may collect your personal data including your name, mobile number and address for the purposes of offering, providing and marketing to you the products of the relevant authorised insurers, facilitating the processing and evaluating any applications by the authorised insurers or requests made by you in relation to products offered by the relevant authorised insurers and for such other purposes as stipulated in the yuu Rewards Club PICS. Personal data will be kept confidential but, subject to the provisions of any applicable law, may be provided to any of affiliates of and persons associated with the relevant authorised insurers for the purposes of processing and evaluating any applications or requests made by you in relation to products offered by the relevant authorised insurers, providing subsequent services to you, and for any purposes in connection with any claims made by or against or otherwise involving you relevant to the policies issued. We will only use your personal data for a new purpose other than the said purposes when the relevant consent is obtained from you. Further, we will only use your personal data for direct marketing purposes and transfer your personal data to the relevant authorised insurers for use in direct marketing and to be used by the relevant authorised insurers for direct marketing purposes when the relevant consent is obtained from you.

7. DFI is a licensed insurance agency registered with Hong Kong Insurance Authority (licence number: GA1026) appointed by the authorised insurers and authorised to promote and market insurance products of the relevant authorised insurers as agent.

8. In case of any dispute, DFI and the relevant authorised insurers reserve the right of final decision.

9. This material is for distribution in Hong Kong only.

yuu Insure Monthly Reward Day - Terms and Conditions

1. The yuu Insure Monthly Reward Day ("Programme") commenced on 8 April 2025, and will continue until further notice. ("Promotion Period"). Redemption Period runs from 12:00nn on the 8th of each month to 11:59pm on the last day of each month ("Redemption Period").

2. To participate in the Programme, yuu Member must be an existing yuu Insure customer with at least one active insurance policy(ies) enrolled via yuu (excluding Sport Guard and Health & Go) in the last calendar month ("Eligible yuu Insure Customer (s)"). The policy record can be found in yuu App under the “Account” > “My Plans” section, the Plan Status of active insurance policy(ies) should be shown as “Enforce”. All record will be based on the system records of DFI Development (HK) Limited ("DFI"). Life insurance policy records will be updated after underwriting or the cooling-off period determined by the designated insurers. DFI will not compensate for any losses if there is any delay in updating policy records.

3. Each Eligible yuu Insure Customer will have the chance to get one 7-Eleven Coupon (“Coupon(s)”) with face value of HK$20 through yuu App for free during each Redemption Period of each calendar month. The Coupons are available on a first-come, first-served basis, while stocks last.

4. The Coupon can be used when you spend $20* or above. (Present the Coupon to enjoy $20 off when spending $20 or more at 7-Eleven Hong Kong branches) Coupon is valid for 90 days from the redemption date. For other terms and conditions of the Coupon, please refer to the relevant offer page in the yuu App.

5. DFI reserves the right to change the Terms and Conditions of the Programme without prior notice. DFI reserves the right to interpret these Terms and Conditions. In case of any disputes, DFI’s decisions are final.

6. DFI is a licensed insurance agency registered with Hong Kong Insurance Authority (licence number: GA1026) appointed by the authorized insurers and authorized to promote and market insurance products of the relevant authorized insurers as agent.

7. In case of any dispute, DFI reserves the right to make the final decision.

8. If there is any inconsistency between the Chinese and English versions, the English version shall prevail.

[[qrcodeTitle]]

[[qrcodeDescription]]